The Quiet Crisis

History

In the aftermath of the mortgage meltdown, brought on by Wall

Street's singular pursuit of sub-prime profits, all Floridians have

suffered massive 30-70% declines in our home

values.

Headlines, Spring 2013

The major media outlets continue to feature headline stories of a newly prosperous economy, an excellent employment outlook, and "happy days" returning to real estate values.

The National Association of Realtors proclaims that we have returned to a sellers market! Of course, that same NAR told us, even throughout 2008, that fundamentals remained strong, and home values would long continue to rise...

The low end of the market has been pummeled for 5 years, and hedge funds are stepping in to buy single-family homes, in quantity, for rentals.

But what about the high end? Activity has been sparse for

years now, except for all-cash buyers, mostly from overseas.

Jumbo financing remains frozen. Move-up homebuyers can no

longer move up, because their choice is between a credit destroying

short-sale, or bringing a huge check to close the

sale of their existing home.

The weakest owners have already been flushed out by foreclosures. Only the strong have been able to last this long. But luxury neighborhoods remain in a state of quiet distress, and no end is in sight.

Insights and data,

credit:

zerohedge.com/news/2013-02-25/guest-post-its-always-best-time-buy

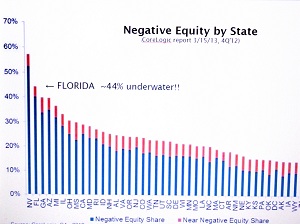

Florida

44% of Homes Still Underwater

Here is where the move-up buyers are. If they live in

Florida and have a mortgage, 44% of them will need to short-sell,

if their bank will allow it. They will not be able to qualify

for a mortgage for many years to come. And of course they

will lack the traditional equity boost from resale, to fund a

move-up down payment.

If Your House is Overfinanced

First, recognize reality. You will have to deal with it sooner or later, and later will tend to be much more expensive.

Do not listen to a fantasy pricing analysis by a Realtor who is trying his or her best to get your listing. The market will not be fooled, and it might cost you valuable months to know you've overpriced.

Run your own comps! Ignore "listed" prices. Look only to actual sales prices of homes near you, in similar neighborhoods, similar beds/baths/square footage, sold within the last 6 months! Realtors no longer have a monopoly on such information, and it is the only real basis for a pricing decision. Free websites such as zillow.com, trulia.com, and many others, offer this hard data. Caution: these and other sites make their money from Realtor ads, and are strongly skewed towards showing listed prices and ads for friendly local agents! You must be very vigilant, and select only "recently sold" data within 6 months. You will be amazed at how your search will repeatedly default to listed prices!

Armed with your comps, compare your estimated price to your indebtedness, plus the normal seller closing costs (~4%, plus 5-6% if a Realtor is used).

Our Methods

Knowledge and Creativity

Our methods work for all sellers, both those with high levels of accumulated equity in their homes, and those who find themselves moderately to severely underwater.

And we are able to qualify a much wider variety of purchasers than traditional lenders. In this era of Dodd-Frank and non-QRM risk retention, Jumbo mortgages and loans for those who are self-employed or who have high but variable income, are virtually non-existent. We can make these deals possible.

We can also provide answers for families who are ready to move

up, but for the credit impacts of their own traumatic

experiences. For buyers with adequate, demonstrable income,

and a solid down payment, we have new answers.

Our methods include:

- Enhanced Seller-Financing

- Lease/Options

- Buyer Equity Recaps

-

Facilitated Requalifications

- Land Trust Intermediation

- Guided Short Sales

-

Buyer Amortizations

We let you define your objectives, then we structure a

transaction to fit.

Call us for a free, no stress analysis, and a complete explanation

of the strategies we might suggest for you.